Innovation is one of the fundamental requirements for banks and credit unions to remain competitive in the future. While the largest financial institutions have spent millions of dollars building internal innovation labs and hiring innovation teams, this option is cost prohibitive for the vast majority of banks and credit unions.

Innovation is one of the fundamental requirements for banks and credit unions to remain competitive in the future. While the largest financial institutions have spent millions of dollars building internal innovation labs and hiring innovation teams, this option is cost prohibitive for the vast majority of banks and credit unions.

In response to the need to provide innovation support for those organizations wanting to keep pace with change, but unable to fully fund or support these efforts independently, a shared innovation lab for regional and community banks has been created. The Alloy Labs Alliance is hoping to address innovation needs and quicken the pace of innovation across the industry along the way.

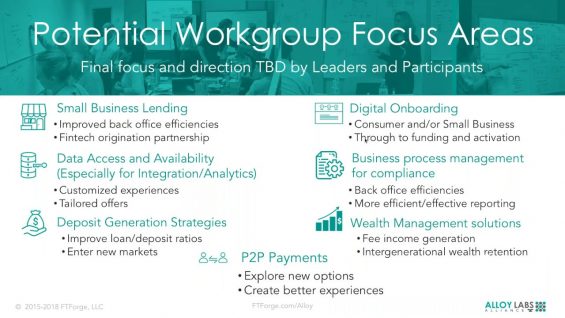

Launched in private beta by FinTech Forge in conjunction with 12 founding banks in 2018, the consortium has been expanding carefully; accepting just 20 additional banks as charter members in the first quarter of this year. The group has already launched three peer work groups for member banks to work together on areas of common interest so far: P2P payments, digital client onboarding, and small business lending, with more work groups to be announced.

Banking Industry Support

Recently, the American Bankers Association announced a strategic partnership with the group to help foster innovation and fintech adoption throughout its membership. “Through Alloy, community and midsize banks can tap into the technological transformation taking place in banking innovation labs across the country without having to do it on their own,” said ABA President and CEO Rob Nichols in their announcement. “Our strategic partnership with Alloy is part of ABA’s ongoing commitment to ensure that banks of all sizes have the knowledge, tools and resources they need to serve their customers and communities today and in the future.”

The Alliance is operated on behalf of its member banks by FinTech Forge, which was founded in 2014 by two well-known fintech entrepreneurs, Jason Henrichs and JP Nicols. Henrichs, who has experience as an engineer, a corporate executive, a founder, an angel investor, and a venture capitalist, may be best known as the co-founder of PerkStreet Financial, one of the world’s first digital-only neobanks. Nicols was an executive at U.S. Bank during a time of its rapid growth, from $6 billion to $400 billion in assets from 1992 to 2012, and has been a prominent advocate for innovation in the industry.

I sat down with the two of them to talk about the Alloy Labs Alliance and how they hope to change the innovation landscape in financial services.

How did a strategic partnership between Alloy Labs Alliance and the ABA come about?

Henrichs: We had done some work with the ABA and had gotten to know a number of their people pretty well, and quite a few of our founding banks were also ABA members. The ABA understands how important it is for banks to innovate in these rapidly changing times and how challenging it is from a resource perspective. Their members look to them for help in addressing their challenges, and we brought a unique approach that was generating results.

Nicols: I talk a lot about how one of a leader’s most important roles is the effective and efficient allocation of limited resources. This includes not just financial resources, but also human resources, technical expertise, managerial time and attention. All of these are limited resources, and banks really need a way to ensure that they are being utilized in a way that delivers results fast with minimum waste. Our consortium approach helps banks do that and the partnership with the ABA also was a really good way for us to maximize our impact with a trusted industry partner.

What’s unique about your approach to innovation?

Henrichs: Many smaller financial institutions were looking to build partnerships with fintech firms, but not much substantial was actually being done. Many of these efforts were what I like to call the ‘fintech petting zoo’. Discussions were occurring, but most was really very superficial. The issue to us wasn’t merely increasing contact with fintech firms, but making it easier to partner. Our focus is on moving relationships between fintech firms and banking organizations forward towards meaningful results.

What are the underlying issues financial institutions face with innovation?

Nicols: Accelerators are great for helping an early stage company take a nascent idea and develop it into a viable company, but that’s not what financial institutions need. They need an internal accelerator process that can help them take a nascent idea and develop it into a viable product or service inside the enterprise. In addition to solving the product/market fit out in the market, they also have to make it work with a number of internal constituents and constraints.

Henrichs: There are also issues when trying to create innovations internally. The largest financial institutions have hired some really good people, and they have picked up the pace on bringing innovative new products and features to market. Most of them were not developed completely in-house, so some strong fintech partnerships had to be developed to help make that happen. The biggest issue we hear from the largest institutions is about the disconnect between the innovation team and the people running the products and business lines day to day.

At best, there is the expected creative tension between those managing the business as usual and those charged with creating completely new things. That’s to be expected, as organizations try to balance the need to extend and defend their existing core businesses (while also trying to create new options for themselves).

At worst, the process of internal innovation can be paralyzing, with internal turf wars and budget battles grinding progress to a halt. The protectors of the status quo start to ignore some really good ideas just because they didn’t come from within the business line. It’s like a full body rejection of an organ transplant.

Nicols: Those corporate antibodies can be very powerful when they perceive a threat.

How does the Alloy Labs Alliance help with these issues?

Henrichs: Most of the organizations we work with are a little earlier in the process, so we can help them avoid a lot of these issues. We help them create what we call a ‘Declaration of Innovation’, which helps them articulate the strategic imperatives for their innovation strategy and establishes foundational frameworks for funding, governance, decision making, and risk management. It’s much easier when we confront these issues up front with clearly understood objectives.

Nicols: We can even assist those institutions that already have a relatively well structured innovation process. If you look at our group of 12 founding banks, and the 20 charter members that joined us as soon as we came out of private beta with the founders, they are a pretty diverse group in terms of size, location, and market focus.

But, the one thing they all had in common is that they all hit above their weight class in terms of trying new ideas and bringing them to market. Not just Lincoln Savings, which was featured by The Financial Brand in an article, but also firms like Mercantile Bank of Michigan. They are about a $3 billion bank, but they were the first bank in the country to partner with PayPal, back in 2010. We have a lot of successful banking innovators who have seen value in collaboration.

Are your member banks worried about collaborating with potential competitors?

Nicols: We handle that a couple of ways. First, the research and survey and heatmap data that we share with the broader membership are anonymized … and frankly, most members value the chance to talk with their peers on our private Slack channel and in our virtual and face-to-face meetings. Our geographic diversity means that most members are not direct competitors, so they can speak openly about their own questions and challenges with a peer from thousands of miles away.

Secondly, the real hands-on detail work takes place in the peer work groups, where members can choose what areas they work on with which other members. In most cases, there is a recognition that even working with the bank across the street to adopt technology doesn’t mean they are going to deploy it in the same way. Modern software provides much greater flexibility than previous ‘one size fits all’ options from the traditional core providers.

Henrichs: Our members also tell us they are less concerned about other regional and community banks. They see the real competition as the mega-banks and the mega-tech platforms. That’s where they really have technology and funding disadvantages that can be addressed by working together.

Many of the ideas they are working on can actually benefit from the network effects of more participants, not to mention the opportunity to share the costs, share the risks, and maybe just as importantly, share the learnings along the way. A Chief Strategy Officer of a $12 billion member bank told us, “We test about 20 proofs of concepts a year, with 1-2 ending up in production. By working with others, we hope to test 30 a year and improve the hit rate to 7-8.”

Bottom line, they would rather have 10 smart people from 10 different banks working on a problem, than 10 smart people all from their own bank. Being a member of the Alliance helps improve both the effectiveness and the efficiency of their internal innovation efforts.

What are your member banks working on today?

Nicols: We launched three peer work groups already this year. We have one on P2P payments, one on digital client onboarding, and one on small business lending. We are not ready to make any public announcements about any of them just yet, but we are pleased with the progress and our members are excited about some of the really unique opportunities we are exploring.

Henrichs: We will be launching more work groups in other areas soon. All of the topics are member driven, and we start by helping them define and refine the specific problem they’re trying to solve or the opportunity they are pursuing. We synthesize the group discussions into a functional spec, and curate a shortlist of potential fintech partners leveraging the knowledge of the group and our relationships with top venture firms and accelerators.

Finalists then go through business, security, and compliance screening through our strategic relationship with Crowe LLP. The leader banks of the work group test not just for technical feasibility, but also customer desirability and business viability.

We then document all of the above, plus all of the learnings and best practices, and include a negotiated common contract with group discount to create a full blueprint and implementation kit so that any member banks that weren’t a part of the work group can still benefit from the work. As one member put it, “It’s like starting a 12 month project at month 9.”

Do you help member banks invest in fintech firms?

Henrichs: Just as most banks don’t know where to start and can’t afford to build their own innovation lab, most also can’t afford to build out their own CVC (corporate venture capital) arm. We’ve built out 8 CVC functions for financial institutions, providing a quality deal flow which is easier to do as part of a group.

We are focused on strategic investments that will most likely provide an attractive financial return, a true partnership and a strategic advantage for our members. This is a natural fit for the specific areas that members are working on in the work groups, and it gives organizations a chance to own a piece of the upside, as the solutions they helped develop are adopted by more and more institutions.

How did the concept of Alloy Labs Alliance originate?

Henrichs: We both had done our share of consulting, and had grown tired of delivering PowerPoint presentations to boards and leadership teams who may or may not actually act on the advice provided. Unfortunately, even with good intent, most organizations we had met with individually had other priorities that took precedence over innovation programs.

Both JP and I were writing and speaking about the need for more innovation in the industry, with JP also teaching classes about innovation at some of the graduate schools of banking. I had sketched out a business model and the outline of what is now our core underlying innovation philosophy called FIRE™ (Fast Iterative, Responsive Experiments). We were clearly on the same page, so it only made sense to combine our efforts.

Nicols: We both had also been involved in building communities of innovators. Jason is co-founder of FinTEx, the Chicago not-for-profit that is expanding the fintech ecosystem across the Midwest, and I co-founded the Bank Innovators Council in 2013. We both knew from firsthand experience that being an innovator inside a traditional financial institution can be lonely, and that they all love talking with one another and sharing ideas.

I sometimes describe ourselves as an ‘outboard’ innovation department. ‘Outboard’ meaning that each of our members steer their own ship, but we provide outboard power when they need it. Not every organization can afford to build their own innovation lab, but none can afford not to innovate in this era of digital disruption.

[“source=thefinancialbrand”]