Rudra Shares & Stock Brokers

Overview on buyback details

Wipro has approved buyback of 32,30,76,923 fully paid-up equity shares of face value Rs 2 each, representing up to 5.35 percent of the total number of equity shares. The buyback is fixed at a price of Rs 325 per equity share for an aggregate amount of up to Rs 10,500 crores via tender offer.

The record date for the said purpose is set to be June 21, which translates June 19 for participation in buyback. Wipro is buying back its shares at a premium of 10 percent to the current price of Rs 296.

Buyback Strategy

Wipro has always been providing rewards to its shareholders. With this buyback being fancy and retail participation hiking up further, we have estimated that the eligibility ratio would be 60-65 percent. Taking into consideration the least number of retailers that would not participate, the real acceptance ratio has been assumed higher only by 15-20 percent. So, the estimated acceptance ratio could be around 70-75 percent.

CASE A

Hedging through future not advisable

As per calculations, the estimated acceptance ratio is around 70-75 percent at the most. The retail holding (individuals holding up to Rs 2 lakh equity share capital) in Wipro is only 1.89 percent (as in March). The buyback amount being high, there is no doubt that many more investors are expected to participate in this buyback. Moreover, the low base of retail holding provides cushion for higher eligibility ratio.

We have estimated 640 as the maximum shares that can be bought at CMP at Rs 296, keeping the limit of Rs 2 lakh (as stated by SEBI). This represents the total value of around Rs 1,89,440 as the margin set aside or any price rise before record date.

The acceptance ratio being high, the remaining 25 percent shares would be hedged through future, which translates in to 160 shares (640*25 percent) that needs to be tendered in 20 accounts to match the future lot size of 3,200 shares. To have 20 different accounts for a retail investor is quite not possible. Thus, hedging is not advised in Wipro Buyback.

CASE B

Gain through tender offer – direct market purchase

Investors looking for a short-term gain can buy 640 shares at CMP at Rs 296 in the open market and give them in the tender offer. Also, one has to monitor that shareholders’ holding value should be less than the amount of Rs 2 lakh on the record date to qualify for this buyback.

As per SEBI regulations, 15 percent of the offer size will be reserved for retail shareholders (holding amount less than Rs 2 lakh). Therefore, Rs 1,575 crore (15 percent of 10,500 crore) is set for retail Investors.

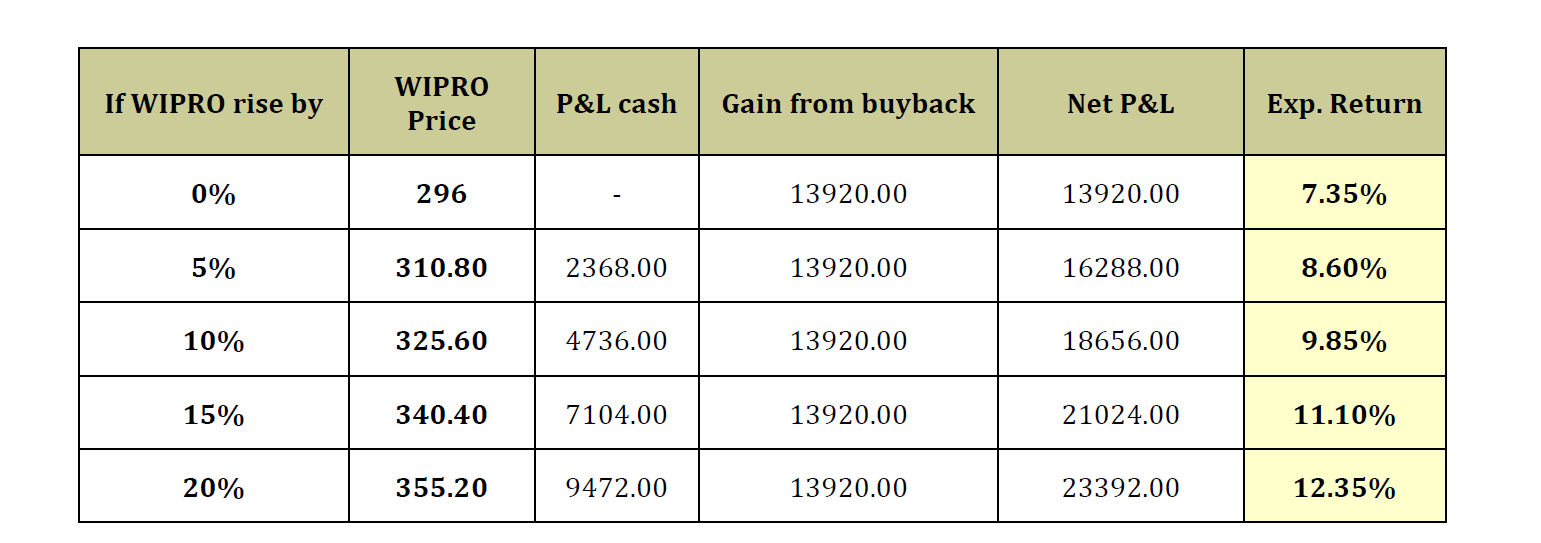

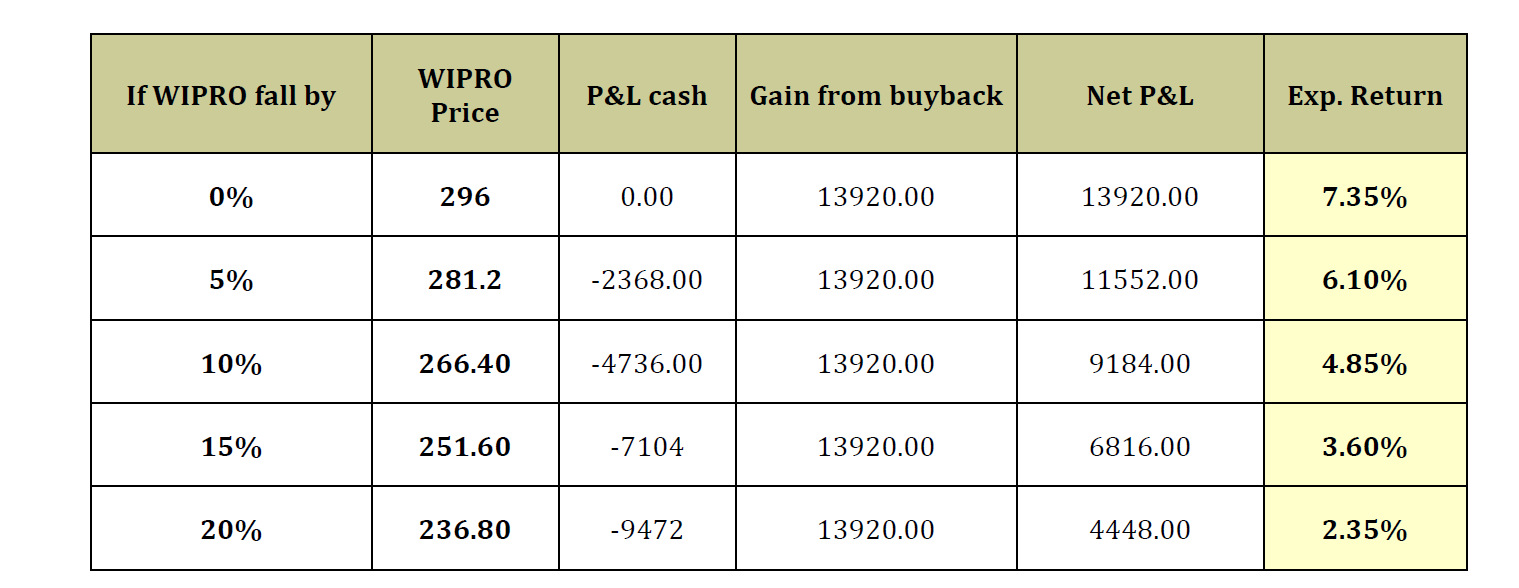

Expected returns and conclusion

Though the company’s Q4FY19 performance missed estimates, the guidance growth stated by the management is not very lucrative. However, this being the third buyback for Wipro, we believe it would help increase the EPS and support the company’s share price.

The estimated acceptance ratio as per calculations is also reasonable at 70-75 percent, which makes the buyback attractive. Thus, investors may tender their shares (case B stated above) to enjoy return up to 13 percent (within two months) through this buyback opportunity, and the remaining quantity (not been accepted in buyback) may be sold in the open market.

[“source=moneycontrol”]